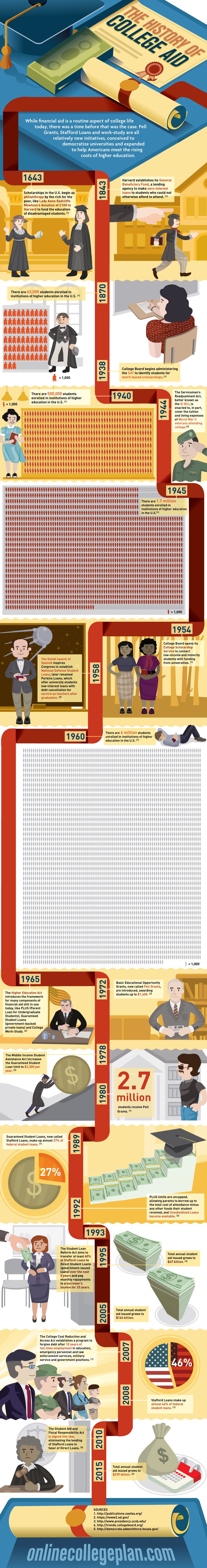

The History of College Financial Aid

While financial aid is a routine aspect of college life today, this hasn’t always been the case. Pell Grants, Stafford Loans and work-study are all relatively new initiatives, conceived to democratize universities and expanded to help Americans meet the rising costs of higher education.

The History of Financial Aid

1643: Scholarships in the U.S. begin as philanthropy by the rich for the poor, like Lady Anne Radcliffe Mowlson’s donation of £100 to Harvard to fund the education of disadvantaged students. (1)

1843: Harvard establishes its General Beneficiary Fund, a lending agency to make zero-interest loans to students who could not otherwise afford to attend. (1)

1870: There are 63,000 students enrolled in institutions of higher education in the U.S. (1)

1938: College Board begins administering the SAT to identify students for merit-based scholarships.(1)

1940: There are 500,000 students enrolled in institutions of higher education in the U.S. (1)

1944: The Servicemen’s Readjustment Act, better known as the GI Bill, is enacted to, in part, cover the tuition and living expenses of World War II veterans attending college. (2)

1945: There are 1.7 million students enrolled in institutions of higher education in the U.S. (1)

1954: College Board opens its College Scholarship Service to connect low-income and minority students with funding from universities. (1)

1958: The Soviet launch of Sputnik inspires Congress to establish National Defense Student Loans, later renamed Perkins Loans, which offer university students low-interest loans with debt cancellation for service as teachers after graduation. (2)

1960: There are 4 million students enrolled in institutions of higher education in the U.S. (1)

1965: The Higher Education Act introduces the framework for many components of financial aid still in use today, like PLUS (Parent Loan for Undergraduate Students), Guaranteed Student Loans (government-backed private loans) and College Work-Study. (2)

1972: Basic Educational Opportunity Grants, now called Pell Grants, are introduced, awarding students up to $1,400. (2)

1978: The Middle Income Student Assistance Act increases the Guaranteed Student Loan limit to $2,500 per year. (3)

1980: 2.7 million students receive Pell Grants. (1)

1989: Guaranteed Student Loans, now called Stafford Loans, make up almost 27% of federal student loans. (1)

1992: PLUS limits are uncapped, allowing parents to borrow up to the total cost of attendance minus any other funds their student received, and Unsubsidized Loans become available. (2)

1993: The Student Loan Reform Act aims to transfer at least 60% of Stafford Loans to Direct Student Loans (government-issued loans) over the next 5 years and peg monthly repayments to a borrower’s income for 25 years. (2)

1995: Total annual student financial aid issued grows to $47 billion. (4)

2005: Total annual student financial aid issued grows to $146 billion. (4)

2007: The College Cost Reduction and Access Act establishes a program to forgive debt after 10 years of full-time employment in education, emergency personnel and law enforcement services, military service and government positions. (1)

2008: Stafford Loans make up almost 46% of federal student loans. (1)

2010: The Student Aid and Fiscal Responsibility Act is signed into law, eliminating the lending of Stafford Loans in favor of Direct Loans.(5)

2015: Total annual student financial aid issued grows to $239 billion. (4)

2022: The total amount of aid that undergraduate and graduate students received in 2021-22 from all grants, scholarships, and federal programs was $234.6 billion.

Sources:

1. https://publications.nasfaa.org/

3. https://www.presidency.ucsb.edu/

4. https://trends.collegeboard.org/

5. https://democrats.edworkforce.house.gov/