Online Accounting Degrees

Find your degree

Complete Guide to Accounting Online Degrees

“Accountants are the cowboys of information.”

-David Foster Wallace

Accountants aren’t afraid to get into the nitty-gritty of numbers, dollars and cents, even handling large amounts of data and serious sums of money. They can save businesses from serious financial mistakes and uncover major fiscal crimes. Or they may be everyday heroes who guide individuals through the intimidating complexities of tax season.

Accountants are like the physicians of an organization; they assess a company’s financial health, balance its financial systems and prescribe organizational changes to help it thrive. They have relentless attention to detail and also have the power to see the big picture, along with the integrity it takes to handle vast amounts of sensitive data and money. If you have a head for numbers and take satisfaction in making them balance out just right, you may be cut out for a career in accounting.

People and businesses work hard for their money, and don’t trust just anyone to handle it. That’s why accountants are held to high standards in education and professional practice. That’s also why accountants are well-paid. These professionals make great salaries and have a range of positions open to them, from taxes and payroll to c-suite finance roles. That’s the reason sources like Forbes and U.S. News and World Report rank the role of accountant as one of the best and most in-demand jobs on the market today.

What is an Accountant?

Accountants draw up and analyze financial records, ensure the accuracy of accounting records, calculate and pay taxes, asses the financial health of organizations, and help them to run more efficiently. Accountants may specialize in personal finances, forensic accounting, taxation, or other areas of finance.

Accountants must have great skills in math, organization, analysis, and an eye for detail. They must be thorough and highly principled in order to handle large amounts of money and complex budgets and other financial systems. They are also technically savvy, and able to use and adapt to rapidly evolving accounting software and filing systems.

What Do Accountants Do?

Depending on their area of specialty, accountants may perform a number of job duties on a day-to-day basis, like:

- Comparing financial statements

- Calculating a payroll

- Analyzing business data

- Preparing and filing taxes

- Balancing a budget

- Inspecting bookkeeping for errors

Accounting offers plenty of flexibility, with room to specialize in a number of areas. Accountants almost always work full time, and 1 in 5 work over 40 hours per week, according to the Bureau of Labor Statistics. Many accountants work for themselves, which allows them control over their business and scheduling. Their hours may be slower at some times of the year and may go into high gear during tax season, at the end of the fiscal year or even at the end of each month.

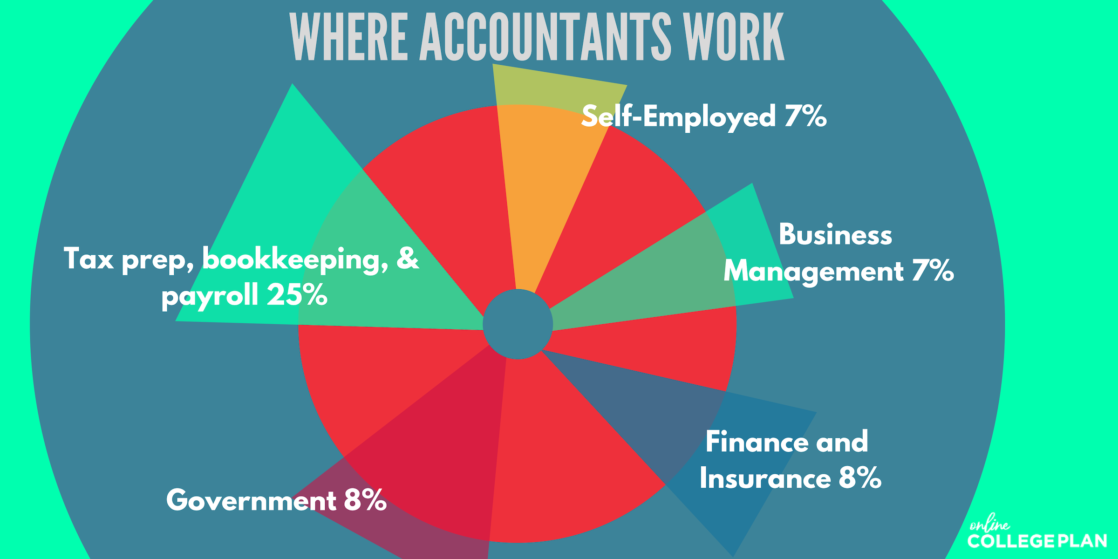

Where do Accountants Work?

Every type of business needs accounting services, and larger organizations keep more than one on staff. Accountants can work for organizations, for themselves, or in an accounting practice. Those that work for businesses can choose a small business, a large or small company, a nonprofit, or federal or local government. Certain licenses are necessary for different roles- for instance, an accountant with the government may need a Certified Government Financial Manager (CGFM) license, and one filing taxes for a publicly traded company will need to be a Certified Public Accountant (CPA).

Accountants who work for accounting firms may specialize in a certain type of accounting, such as assurance services, or risk management. They may also specialize in serving a particular industry, such as education, manufacturing, or healthcare. The overwhelming majority of publicly traded companies get their accounting services through one of the Big Four accounting firms: Ernst & Young, Deloitte, KPMG, and PricewaterhouseCoopers. Many accountants aspire to work with one of the prestigious Big Four accounting firms, and doing so can also open doors to high-level opportunities with other employers.

What is a CPA?

More accountants work as Certified Public Accountants (CPAs) than any other role. Only Certified Public Accountants are qualified to write and file the financial records, like audited financial statements, balance sheets, and tax forms, that companies are required by law to publicly disclose. Because CPAs have special training and are held to explicit standards of conduct, the government requires that only CPAs sign off on the documents that publicly traded companies with the Securities and Exchange Commission (SEC). With their advanced training and ability to perform such tasks, CPAs make 10-15% more than accountants with the same degree but no CPA certification, according to the Association of International Certified Professional Accountants.

CPAs perform a variety of financial and accounting tasks. They do audits, calculate and file taxes, and consult with clients on their finances. They work not only with companies but government organizations and individuals. A CPA might help an individual prepare their taxes or advise a nonprofit on how to handle payroll matters to save expenses. Most CPAs work for accounting firms, including the Big Four, or for themselves.

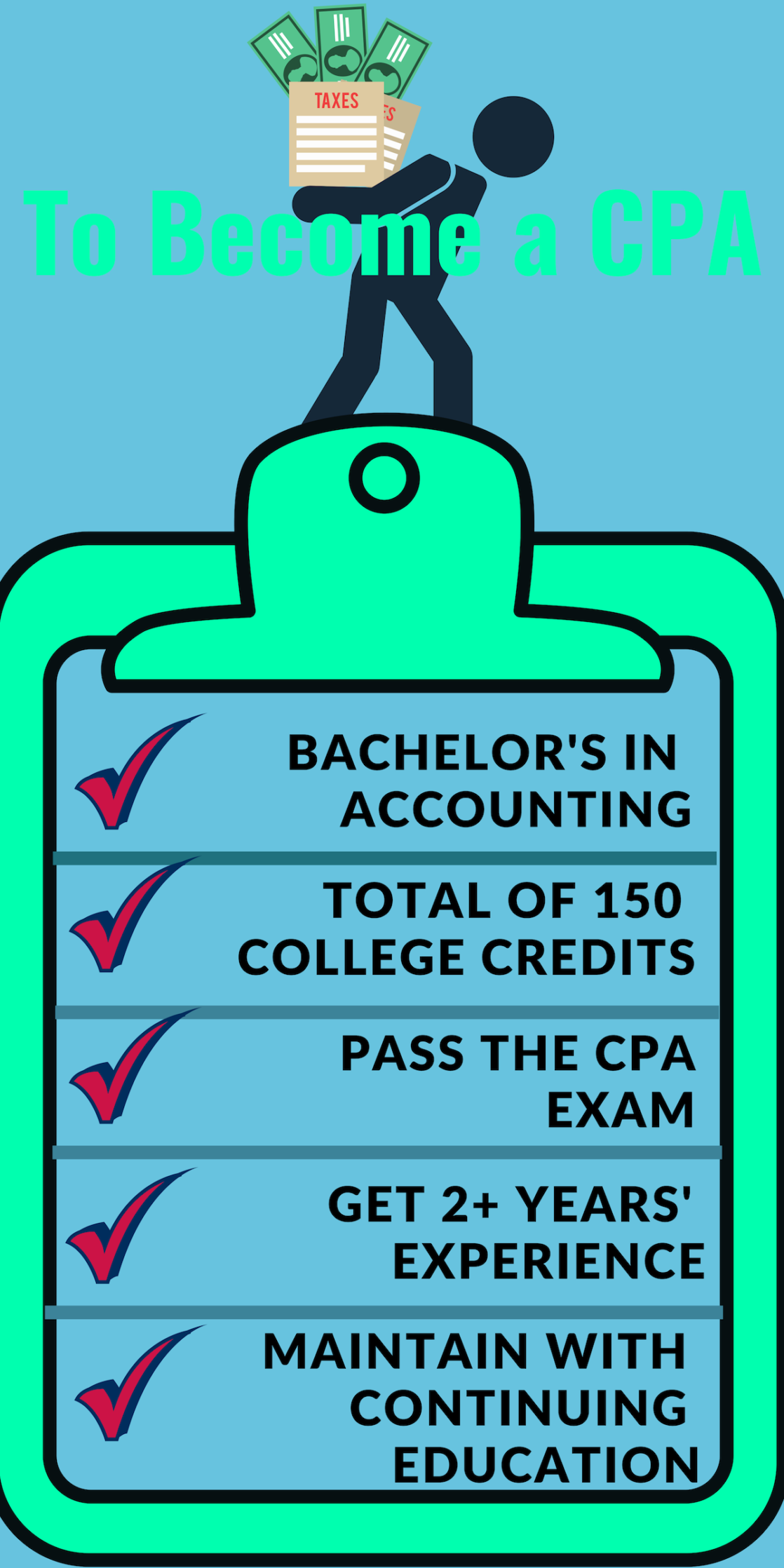

CPAs are licensed at the state level by their state’s Board of Accountancy. That means that the requirements to become a CPA vary from state to state, with some being more stringent than others. For the most part, states require education, experience, and examination as their qualifications for becoming a CPA.

In order to become a CPA, most states require 150 college credits, two year’s experience, plus a passing grade on the Uniform CPA Exam. Since most bachelor’s degrees cover only 120 credits, you’ll need extra coursework to qualify at this level. Many opt for a five-year combined bachelors and master’s program, others choose to take additional undergraduate classes beyond their accounting bachelor’s degree to meet the 150 credit requirement.

After graduation, you’ll need to gain at least 2 years’ professional public accounting experience, a number which will depend on your state’s specific requirements. This requirement is designed to prepare CPAs with real-world experience, rather than just book learning. It is important that your experience is in public accounting rather than a related field, such as government accounting. Those who gain experience in a related field of accounting will typically need more hours to meet the experience requirement.

Once you’ve gained your bachelor’s degree in accounting and full 150-credit hours, and satisfied the experience requirement, you’ll be ready to sit for the Uniform CPA Exam. The test is administered by the American Institute of Certified Public Accountants (AICPA) and this exam is notoriously tough. In fact, about half of test-takers fail the CPA exam on their first attempt. Each application and test attempt requires paying a $1,000 fee, but many employers will cover these costs in order to get their public accountants qualified as CPAs.

The majority of accounting degrees incorporate the content of the CPA exam into their curriculum, but most candidates opt to take a review course as well. There are four parts to the exam, and each may be taken separately, but most states require that candidates pass all four parts within 18 months of each other.

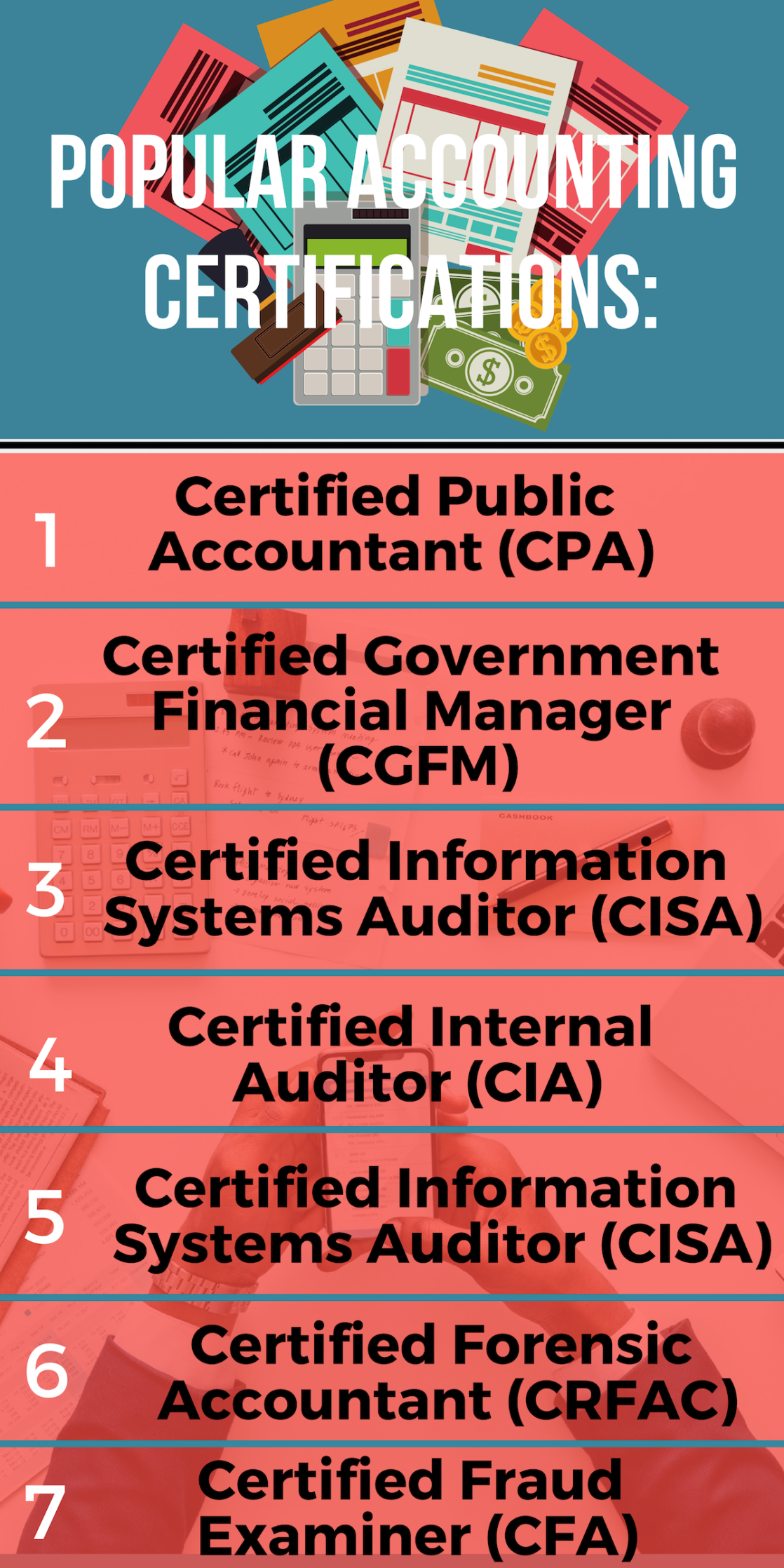

What Other Kinds of Certified Accountants are There?

CPA may be the most popular certification, but Certified Public Accountants aren’t the final word in accounting jobs by a long shot. Other popular positions include Government Accountants, CMAs, Internal Auditors, and CGFMs. Each position has its own credentialing requirements in order to become certified, though you may not need to be certified to find entry-level work within each field. Like the CPA credential, most of these certifications require education, experience, and examination, though the exact requirements vary between each.

Management accountants prepare and organize financial data for an organization. Unlike public accountants, management accountants prepare records for use by businesses themselves, rather than for filing as public records. Their work often covers performance evaluation and budgeting, and their aim is to make businesses run more efficiently. Some work on asset management, the management of investments for an organization, such as its stocks and bonds. the Institute of Management Accountants offers the Certified Management Accountant (CMA) credential.

Government accountants create and analyze government agencies’ financial records. They also perform audits for people and organizations whose activities are subject to taxation or regulation by the government. The Association of Government Accountants offers the Certified Government Financial Manager (CGFM) credential. Other government accountants might want to purse the Certified Fraud Examiner (CFE)credential offered by the Association of Certified Fraud Examiners. Fraud Examiners examine financial records for evidence of fraudulent activity and discrepancies in reporting.

Internal auditors have a similar job description, but they work for organizations, rather than the government, and look for evidence of mismanagement of funds within the business itself. The Institute of Internal Auditors administers the Certified Internal Auditor (CIA) credential, along with other credentials like the Certified in Control Self-Assessment (CCSA) and the Certified Government Auditing Professional (CGAP), and Certification in Risk Management Assurance (CRMA). External Auditors, like internal Auditors and fraud examiners, look for evidence of misuse of funds, but do so as a neutral third party instead of the government or business itself.

Information technology auditors are a type of internal auditors that are in charge of reviewing an organization’s computer systems to be certain that financial data comes from a reliable and valid source. The ISACA (Information Systems Audit and Control Association) awards the Certified Information Systems Auditor (CISA) credential.

How much Money Can I Make as an Accountant?

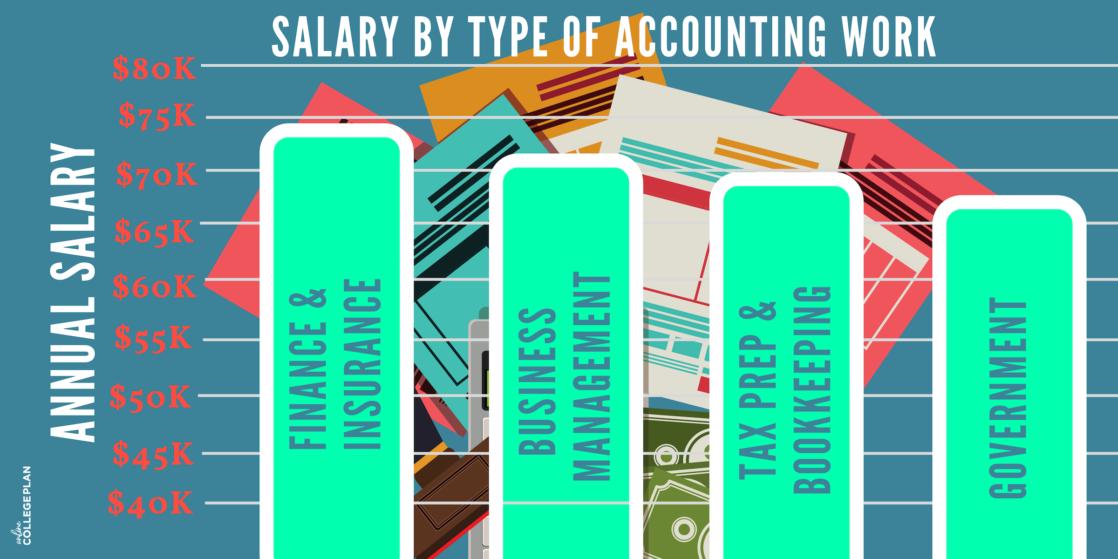

Accounting degrees are associated with great salaries across the board. The Bureau of Labor Statistics (BLS) reports that the median salary for accountants and auditors is $69,350, and those in the highest 10% earn more than $122,220.

There’s also quite a variety in salaries for accountants based on their accounting degree, credentials, field, and geographical area. Certification, living in a populous state, and working in the field of business and finance are all associated with higher salaries. The National Association of Colleges and Employers survey reports that those with just a bachelor’s degree in accounting earned an average of $50,500 in 2012, but their peers with a CPA license earned $73,800 on average, with top salaries of about $124,000. Other licenses, like CISA are also associated with significant pay bumps.

Where you practice matters as well. States with high population density and large economies tend to have the highest salaries with an accounting degree, though these tend to also have a higher associated cost of living. The states with the top salaries for accounting degrees are:

- New York: $93,280

- District of Columbia: $93,210

- New Jersey: $88,940

- Virginia: $83,380

- California: $82,620

What is the Job Outlook for Accounting?

Accountants and auditors are always needed, making this a secure job no matter what the state of the economy. Budgets, audits, and taxes are unavoidable, and professional accountants will always be needed to handle them. That said, all jobs in finance grow with the economy, and the market for those with an accounting degree is no exception.

The Bureau of Labor Statistics reports that there were 1,397,700 people working as accountants in 2016, and projects that another 139,900 jobs in the field will be added by 2026. That’s a 10% rate of growth, faster than the national average.

The future of accounting will likely see an increasing reliance on technology like cloud computing. Unlike many fields, however, this isn’t anticipated to cut into the number of human jobs available. Rather, accountants in the future will be increasingly freed up from repetitive accounting tasks, which will be more automated, and jobs will focus more on forecasting, advising and analyzing. The accountant of tomorrow will need to be tech-savvy and aware of issues like information security.

As business becomes more globalized, there will also be more demand for accountants with international expertise, including services in international mergers and acquisitions and in international trade. Students pursuing an accounting degree may wish to consider focusing their coursework on technology and global studies.

What Can I Do with an Associate’s in Accounting?

If you want to get an immediate start in the field of accounting, an associate’s degree in accounting can get you started fast. An associate’s in accounting takes just two years to earn and focuses exclusively on practical accounting skills. This degree prepares you for entry-level accounting work, and classes tend to have a technical, hands-on focus. You’ll learn the fundamentals of accounting, including accounting software, spreadsheets and budgets.

In a typical associate’s degree program, you’ll complete 60 semester credit hours (equal to 90 quarter credit hours), which typically works out to 20 classes. In an accounting associate’s program, you’ll study topics like:

- Payroll Accounting

- Taxation

- Business Math

- Accounting Software Systems

- Auditing

With an associate’s in accounting, you’ll be qualified for entry-level accounting positions like:

- Accounting Assistant

- Payroll Clerk

- Accounting Receivable Clerk

- Fiscal Technician

- Auditing/Bookkeeping Clerk

One thing an associate’s degree in accounting cannot do, however, is allow you to qualify for the CPA exam. For that, you’ll need more than twice as many college credits, which is why many accountants choose to use an associate’s in accounting as a stepping stone towards a bachelor’s degree in accounting or a master’s.

What Can I Do with a Bachelor’s in Accounting?

A bachelor’s in accounting is the most popular degree in the field. Whether you earn an associate’s degree first, pursue a bachelor’s alone, or earn one as part of a combined bachelor and master;’s program, this well-rounded degree program is a smart choice. A bachelor’s in accounting is a four-year undergraduate degree which includes general education and accounting courses.

Unlike an associate’s degree, a bachelor’s degree is aimed at preparing a well-rounded graduate with a broad general knowledge base. That means you’ll be taking plenty of general education classes in liberal arts like English, history, and science, along with classes in your accounting major. You can expect to study the same accounting fundamentals as in an associate’s program, along with broader classes like:

- Economics

- Accounting Law and Ethics

- Information Systems Design

- Principles of Accounting

If you want to become a CPA, you’ll generally need 150 credit hours under your belt. Unfortunately, the average bachelor’s degree covers just 120 semester credits (or 180 quarter credits). This means that if you intend to become a CPA, you’ll want to find a school that offers a more rigorous 150-credit Bachelor’s in Accountancy or continue on for another year. If you’ve graduated from a 120-credit program and wish to become a CPA, you’ll be looking at completing those additional 30 credits through outside coursework. Keep in mind, however, that CPA license requirements vary by state, so research the standards for the state in which you intend to practice before committing to a program.

With a bachelor’s in accounting, you’ll be qualified for entry-level and mid-level accounting jobs that offer plenty of room for growth. These include:

- CPA

- Forensic Accountant

- Corporate Accountant

- Internal Auditor

- Tax Examiner

With a bachelor’s degree in accounting as your foundation, you can also move into a related field, like personal financial advisor or actuary- both lucrative and in-demand positions.

What Can I Do with a Master’s in Accounting?

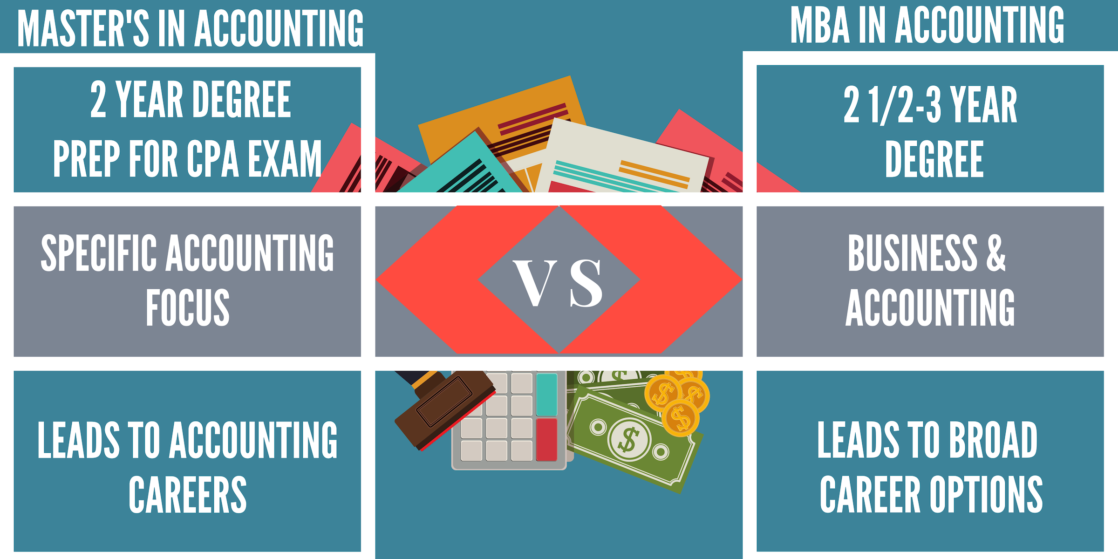

While a bachelor’s degree in accounting is a great foot in the door, and the industry standard in education, most employers prefer hiring and promoting those with a master’s degree. Many top employers even require a master’s in accounting. A master’s in accounting is a two-year graduate degree in advanced accounting studies.. This degree shows a high level of commitment, achievement, and expertise.

To get a master’s in accounting, you’ll need a bachelor’s in accounting or a related field, such as finance, math or business. If you have a non-accounting undergraduate degree, you may need to complete pre-requisites like calculus and statistics.

Depending on your area of specific interest, a master’s in this field is usually offered as a Master of Accounting (MAcc), or a Master of Science in Taxation. A master’s in accounting requires no general education classes, and skips right over the fundamentals, getting to the heart of advanced accounting with classes like:

- Accounting and Public Policy

- Advanced Financial Accounting

- Business Communication

- Auditing and Assurance

- Reporting Standards

Some master’s programs are offered as combined bachelor’s and master’s degrees, which compress both degrees into a shortened time-frame (usually 5 years) and saves students from applying to a second program. Either way, your coursework will provide you with the 150 credits most states require to sit for the CPA or CMA exam, and classes will cover the content you’ll need to know in order to pass. You will likely be required to complete an internship at a company to gain hands-on learning, and will complete a research- or project-based thesis in the final part of your program.

A master’s degree is associated with higher income, even in positions that are open to both bachelor’s level and master’s level employees (such as CPA). Accounting pros with a master’s degree earn as much as 37% more than those with a bachelor’s. With a master’s in accounting, you’ll have a wide range of high-level career options open to you. One of the most popular choices at this degree level is becoming an auditor. This job entails analyzing an organization’s history of financial statements. Other popular jobs with a master’s in accounting include:

- Information and Technology Accountant

- Certified Public Accountant

- Certified Management Accountant (CMA)

- Tax Accountant

- Budget analyst

- Revenue agent

What Can I Do with an MBA in Accounting?

If you have both business acumen and financial analytical skills, you may be interested in an MBA with a Concentration in Accounting. An MBA with a Concentration in Accounting is a 2 and a half to three year degree which provides broad business training as well as classes in accounting. This degree can prepare you for high level managerial roles that require an advanced knowledge of accounting and finance. You won’t get the same type of specific prep for the CPA exam that’s offered in a MAcc degree, or the training in tax procedures that’s part of a MS in Taxation. Instead, you’ll take broader business and management classes combined with accounting concentration classes like:

- Business Communication

- Leadership

- Change Management

- Accounting Research and Writing

- Marketing

With this degree, you’ll be able to take on a management role in the accounting field, leading organizations to fiscal responsibility, stability and growth. Job titles associated with an MBA with as concentration in accounting include:

- Corporate Controller

- Financial Analyst

- Managerial Accountant

- Chief Financial Officer (CFO)

What Can I Do with a Doctorate in Accounting?

If you’re interested in conducting research in accounting or teaching in this field, you might consider a Doctorate in Accounting. This terminal, postgraduate degree is the highest in the field, and generally takes 3-6 years to earn. To earn your PhD in Accounting, you’ll select a topic of interest and conduct original research, develop a thesis and defend it. You can expect to use economics and econometrics to analyze accounting practiced and trends in the course of your thesis, and to find a position as a professor of accounting upon graduation.

Further Reading:

- Top 30 Online Masters in Accounting

- 10 Best Online Bachelors Degrees in Accounting

- Top 24 Online Accounting Degree Programs for Earning Your Bachelors

- Top 30 Online Masters in Finance Degrees

- Top Online PhDs in Accounting

- Top Online PhDs in Finance

- What Are The Top Online Colleges With The Best PhD in Accounting?

- Are There Any PhD In Accounting Online Programs?

- Accountant

- Career Profile: Public Accountant

- Career Profile: Government Accountant

- What Can You Do With a Business Degree?

- What Can You Do With a Finance Major?

- Are Online Masters Degree Programs Worth Taking?

- 20 Best Schools For A Business Management Degree